“If you had ₹1 lakh in 2005, where should you have invested — in stocks, gold, or property for better returns?”

That’s the kind of question that can change your entire approach to money. And today, I’m going to walk you through the answer, not just with numbers, but with a story. A story that can help you make smarter financial decisions in the future.

Why This Comparison Even Matters

Most of us earn, save, and hope that one day our savings will work for us. However, when it comes to choosing where to invest, it can be confusing.

Our parents probably swear by gold or real estate. Millennials are leaning more toward mutual funds and stocks. Who’s right?

Let’s find out by comparing 20 years of performance of these three major asset classes:

- Equity (Stock Market)

- Gold

- Real Estate

1. Equity (Stock Market): The Silent Wealth Builder

Let’s rewind to 2005.

If you had invested ₹1 lakh in the Nifty 50 index, your money would have grown at an average CAGR of around 14–15% over the past 20 years. Despite global crashes (2008, COVID-19) and elections, equity has outperformed other assets in the long run.

For instance, take HDFC Bank — in 2005, its share price was around ₹50 (adjusted for bonuses/splits). In 2025, it’s over ₹1,500+. That’s a 30x return. Not every stock is a winner, but diversified equity (like mutual funds or index funds) historically gives 12–15% returns annually.

₹1 lakh in Nifty 50 in 2005 = ₹10 lakh+ in 2025

2. Gold Returns: The Crisis Hero but Slow Grower

Gold shines during fear. In uncertain times — like recessions or wars — people rush to buy gold. In the past 20 years, gold has given an average CAGR of 13–15 %. But there are long periods where gold remains flat or underperforms. For example, between 2013 and 2018, gold prices remained relatively stable.

Gold was around ₹7,000 per 10g in 2005. In 2025, it’s around ₹70,000+. That’s a 10x return in 20 years — decent, but still lower than equity.

₹1 lakh in gold in 2005 = ₹10 lakh in 2025 (approx.)

NITI Aayog’s Gold Market Report – This provides official insights into gold’s role in India’s economy, including its long-term CAGR outlook

3. Real Estate Returns: Emotionally Loved, Financially Tricky

Real estate is seen as a ‘safe and solid’ investment in India. And it’s true — property bought at the right time, in the right location, can be a goldmine.

But the problem? Liquidity, black money involvement, maintenance, taxes, and long stagnation periods.

From 2005 to around 2013, real estate boomed. But post-2013, demonetisation, RERA, and COVID slowed the sector.

Let’s say you bought a flat in a Tier 1 city for ₹20 lakhs in 2005. That flat could now be worth ₹80–90 lakhs — a 4x–5x return over 20 years.

Compound Annual Growth Rate? Around 8–9% returns over the 20 years (with ongoing costs, this may reduce further).

Also, remember: real estate has a high entry cost (loans, registration, etc.) and low liquidity (hard to sell quickly).

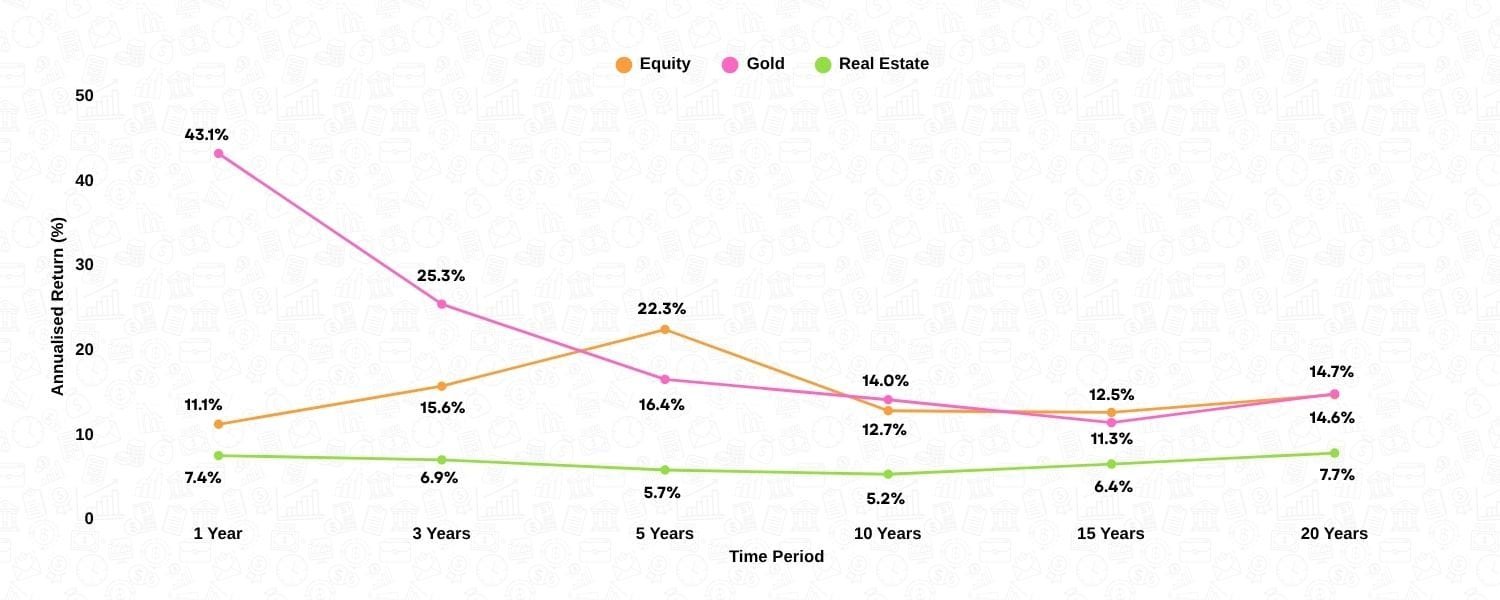

Summary of 20-Year Returns

| Asset Class | CAGR (Approx) | ₹1 Lakh in 2005 = | Liquidity | Volatility | Other Notes |

| Equity | 12–15% | ₹10–12 Lakhs | High | High | Long-Term Growth |

| Gold | 12-14% | ₹9–10 Lakhs | Medium | Medium | Crisis hedge |

| Real Estate | 7–9% (net) | ₹4–5 Lakhs (net) | Low | Low | High entry barrier |

Source: FundsIndia Wealth Conversations – June 2025 (Data till 31 May 2025)

When choosing between Equity, Gold, or Real Estate for better returns, emotions like fear and greed often cloud our judgment. To make smarter, balanced decisions, check out our blog on Fear vs Greed and learn how to manage these feelings while investing.

What This Means for You

Let me bring it to a very human level.

If you’re:

- In your 20s or 30s, with long-term goals → Be friendly with the stock market. In addition to maintaining an emergency fund, start investing in stocks. If you understand the fundamentals and technicals of the stock market (even though most of the time it doesn’t work in the short term), start investing directly for the long term. If you don’t believe in direct investments, choose mutual funds instead. You can add both to your portfolio. Time it doesn’t work in our efficient markets, start investing directly. If you don’t believe in direct investments, choose mutual funds instead

- Someone who wants a safety cushion → Keep a portion (say 10–15%) in gold (via Gold ETFs, Sovereign Gold Bonds).

- Planning to buy real estate → Buy it as a need (home to stay), not just an investment, unless you have excess funds and the real estate market is not already in a boom.

Final Thoughts: The Best Strategy is a Mix

There’s no one winner always.

- Equity = Growth

- Gold = Stability

- Real Estate = Physical comfort or diversification

Diversifying your portfolio based on your risk profile, goals, and age is the key to long-term financial health.

Imagine if 20-year-old you had understood this and started investing just ₹5,000 a month in equity. You’d be a crorepati by now.

The lesson?

Start early. Stay consistent. Understand your assets. Let time do the magic.