Last week, I paid ₹120 for my favourite coffee, which is ₹ 20 more than usual. That’s a 20% increase is not because you’re ordering something fancier, but because the cost of coffee beans, milk, transport, and rent went up. This price increase is called Inflation. An adjustment to a growing economy.

👉 Over a year: ₹20 × 300 days = ₹6,000 extra spent — on just coffee!

What Exactly Is Inflation?

It means prices rise across the board, so your money shrinks in purchasing power.

Impact in plain life: That ₹120 coffee today? Might cost ₹150 tomorrow — not because the coffee’s better, but because inflation is working its magic.

How We Track Inflation

The Consumer Price Index (CPI) measures average price changes.

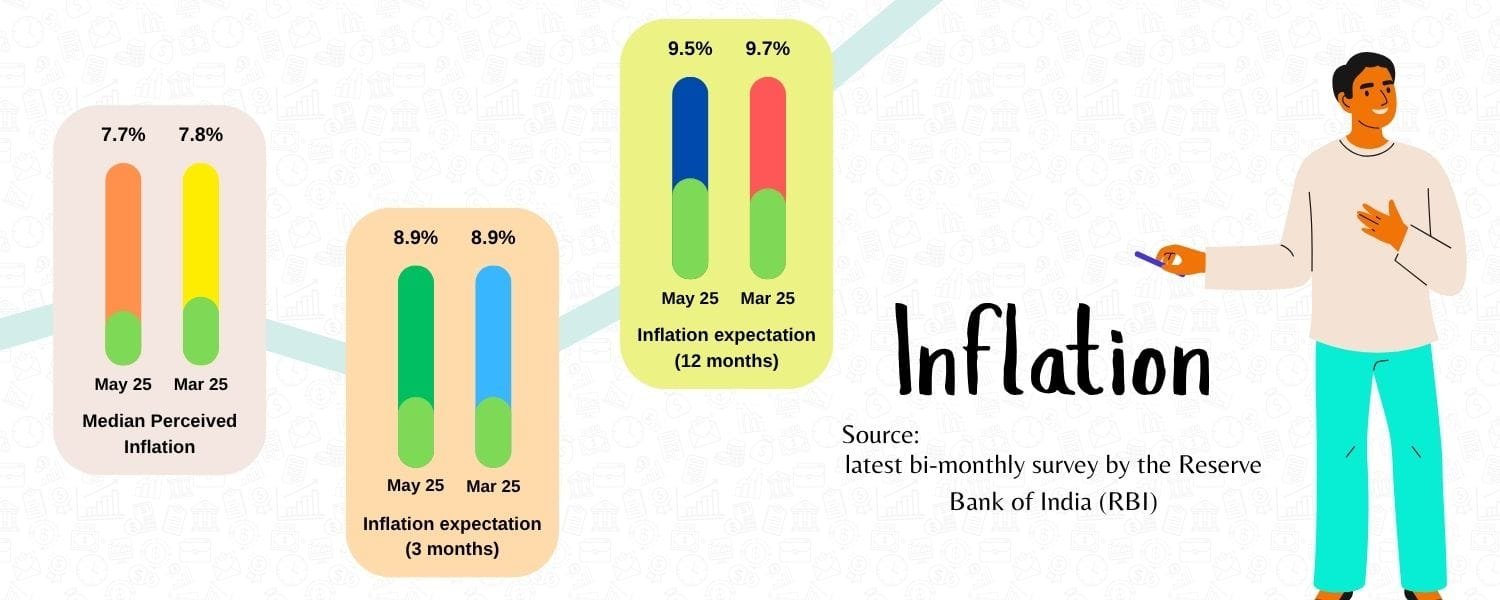

Indian households are reporting slightly lower perceptions of current levels, according to the latest bi-monthly survey by the Reserve Bank of India (RBI). The “Inflation Expectations Survey of Households” for May 2025 reveals that the median perceived rate dropped marginally to 7.7 per cent from 7.8 per cent recorded in March this year.

While expectations for escalating costs over the next three months remained stable at 8.9 per cent, the projected rate for the next 12 months saw a more notable decline of 20 basis points, standing at 9.5 per cent. This suggests a modest easing in inflation-related concerns among consumers.

In the U.S., the University of Michigan June survey shows 1‑year expectations eased from 6.6% in May to 5.1% in June, the lowest in months

| Survey Detail | March 2025 | May 2025 | Change |

| Median perceived inflation (current) | 7.8% | 7.7% | ↓ 0.1% (marginal decline) |

| Inflation expectation (3 months) | 8.9% | 8.9% | No change |

| Inflation expectation (12 months) | 9.7% | 9.5% | ↓ 0.2% (20 basis points drop) |

Source: RBI “Inflation Expectations Survey of Households” – May 2025

Why Prices Keep Rising?

- Demand Surge – Everyone wants the latest phone, so manufacturers hike prices.

- Supply Shocks – A poor monsoon or shipping delays spike food prices.

- Rising Production Costs – Higher wages or raw material costs trickle into your bill.

- Policy Forces – Tariffs or taxes inflate costs. U.S. consumers once feared 7.3% inflation driven by trade tensions

Let’s walk through the key areas inflation hits — often silently at first, then loudly over time.

1. Your Monthly Budget Gets Tighter

Essentials like groceries, fuel, rent, and utilities are more expensive. A family that used to spend ₹25,000 on monthly groceries now spends ₹27,500 — without changing what they buy. That ₹2,500 gap either comes from savings or forces you to cut other expenses (e.g., entertainment, eating out).

Tip: Track prices of essentials. Small rises add up. Budget reviews every 3-6 months can help adjust early.

2. Savings Lose Power

Let’s say you’ve saved ₹1 lakh in a bank account at 3% interest. If escalating costs are 6%, your money’s real value shrinks by 3% per year. After a year, even with interest, your ₹1 lakh only buys goods worth ₹97,000 (in today’s terms). In effect, inflation silently erodes your savings.

Tip: Explore escalating costs-beating options (some equities, index funds, gold, real estate).

3. Emergency Funds Need a Boost

You saved 6 months’ expenses for emergencies — say ₹3 lakh. But with prices up 6%, you now need ₹3.18 lakh to cover the same lifestyle. If Price hikes persist, your buffer may fall short just when you need it most.

When prices rise steadily over time, it doesn’t just affect your day-to-day expenses — it also chips away at the real value of your emergency fund. The ₹5 lakh you set aside a few years ago may not stretch as far today, thanks to the rising cost of essentials like healthcare, groceries, and fuel.

That’s why it’s crucial not only to build an Emergency fund but also to review and adjust it regularly to keep pace with inflation. A fund that felt sufficient before could fall short during a crisis

4. Debt Becomes a Double-Edged Sword

If you owe: Price hikes can be good. Fixed-rate loan EMIs (like for a home loan) feel easier to pay as your income (hopefully) rises.

If you lend (or keep cash): You’re losing out — the money you get back is worth less in real terms.

👉 A ₹50 lakh loan EMI might feel lighter after a few years of inflation, but only if your income keeps pace.

Tip: Focus on paying off variable-rate debts first (as interest rates may rise when inflation spikes).

The RBI’s Monetary Policy Committee (MPC) maintains a 4% CPI inflation target, with a permissible range of 2–6%, set through March 2026. Here is a press release by the RBI.

5. Investment Returns Can Mislead You

Let’s say your investment returned 7% this year. If inflation was 6%, your real gain was only 1%. Many people celebrate nominal returns, but real returns (after inflation) matter more for wealth growth.

👉 It reduces the actual purchasing power of your investment gains.

Tip: Always calculate real returns (return% % minus inflation% %). Look for assets historically beating inflation (e.g., stock market, real estate).

6. Insurance & Long-Term Goals Need Revisiting

That ₹50 lakh life insurance may have felt huge when you bought it, but 20 years of 5% price rise halves its value. The ₹20 lakh you planned for your child’s college in 10 years? It may not be enough — tuition keeps climbing faster than general cost increases.

Tip: Reassess your life cover, health cover, and goal amounts every few years.

7. Lifestyle vs. Price Inflation

As you earn more, you may upgrade your lifestyle (better gadgets, bigger car). Combine that with rising prices, and your savings rate may shrink.

Inflation + lifestyle creep = a dangerous combo that delays financial independence.

Tip: Track your savings rate (aim for 20-30% of income) no matter what price rises or salary jumps.

Final Thought — Make Inflation Work for You

Inflation Is Inevitable, But Being Unprepared Is Not

- Stay Aware, Not Anxious

- Grow Faster Than Prices

- Plan for Tomorrow’s Prices, Not Today’s

- Revisit, Review, Repeat

- Money Talks — So Talk Back

“Every rupee not planned today is worth less tomorrow.”

Inflation isn’t just a rise in prices — it’s a silent pressure on your dreams. But if you’re aware, prepared, and proactive, it can become just another factor, not a fear. It’s not about fearing ₹120 coffee. It’s about making sure that, even if it becomes ₹250 someday, you can still afford it without sacrificing your peace, your savings, or your future. Make your money stronger. Not by working harder, but by planning smarter.

Let this be your mindset:

“I don’t just earn to survive today — I earn, save, and invest to thrive tomorrow.” You’ve got this. So don’t just sit with cash, invest in assets that beat inflation and maintain your standard of living.