Have you ever had some money sitting idle in your bank account and thought, “This could be earning more than just 2–3% interest”? That’s exactly what I felt a few months ago. And that’s when I discovered something that quietly beats a savings account — the Certificate of Deposit, or simply, CD.

Let me explain it to you like I did to one of my closest friends. Imagine we’re chatting over a cup of chai. I promise to keep it simple, point-wise, and practical.

What is a Certificate of Deposit (CD)?

Think of a CD as a fixed deposit with a twist —

- You deposit a lump sum of money with a bank for a fixed term (such as 3 months, 6 months, or 1 year).

- The bank offers a fixed, guaranteed interest rate, typically higher than that of savings accounts.

- But here’s the catch — you can’t withdraw the money before the maturity date without paying a penalty.

In India, CDs are more common among institutional investors (banks, mutual funds), while in countries like the US, even individuals can directly open retail CDs. But we, as individuals, often benefit indirectly through mutual funds and other short-term investments.

Why I Consider CDs a Smarter Option

Let me tell you what made CDs click for me:

- Guaranteed returns: No drama, no market swings — just fixed interest.

- Safe investment: Issued by RBI-regulated banks in India and FDIC-insured up to $250,000 in the US.

- Short-term planning tool: If you have idle cash for 3–12 months, why not earn 7–8% instead of letting it rot at 3%?

A Real-Life Example (with numbers!)

Let’s break it down:

In March 2025, public sector banks in India like Canara Bank and Bank of Baroda were offering CDs at ~8.05% interest (source: Business Standard).

So, if I had invested ₹1,00,000 in such a CD for 6 months, I would earn around ₹4,000 interest — risk-free. In contrast, my savings account would only fetch ₹1,500–₹2,000 for the same period.

Latest Market Trends & Data

Here’s something interesting I came across recently:

- India’s CD issuances jumped to ₹11.75 lakh crore in FY25 — up 34% from the previous year.

- Public Sector Banks (PSBs), which used to issue only 6% of total CDs in FY22, now issue 69% — this shows their growing reliance on CDs for quick funding.

- According to The Hindu BusinessLine, mutual funds heavily subscribed to these CDs due to attractive short-term yields.

In short: CDs are hot — not just among investors like us, but even in the institutional market.

What Are People Saying? (Survey & Behavioural Insight)

Now this blew my mind:

A 2025 MarketWatch Survey found that 40% of people rely on personal recommendations from family and friends when making investment decisions.

That’s exactly why I’m writing this — because when I figured out how CDs work and how they quietly give better returns with low risk, I had to share it.

Also, in the US, retail CDs are seeing massive traction. According to Barron’s, banks held over $2.9 trillion in CDs by the end of 2024. That shows how even risk-averse investors are now turning to CDs.

Key Tips You Should Know

Here’s a crisp list based on what I’ve learned:

- Match your tenure – Choose a CD term that aligns with when you’ll need the money. Don’t lock it in “just for returns.”

- Don’t blindly roll over – When the CD matures, compare new interest rates. Reinvesting at a lower rate could result in losing your gains.

- Ladder your CDs – Break your lump sum into chunks (e.g., 3-month, 6-month, 1-year). This way, one CD matures every few months, giving you liquidity.

- Check early withdrawal penalties – Most CDs deduct 1–3 months of interest if you break it early. Plan accordingly.

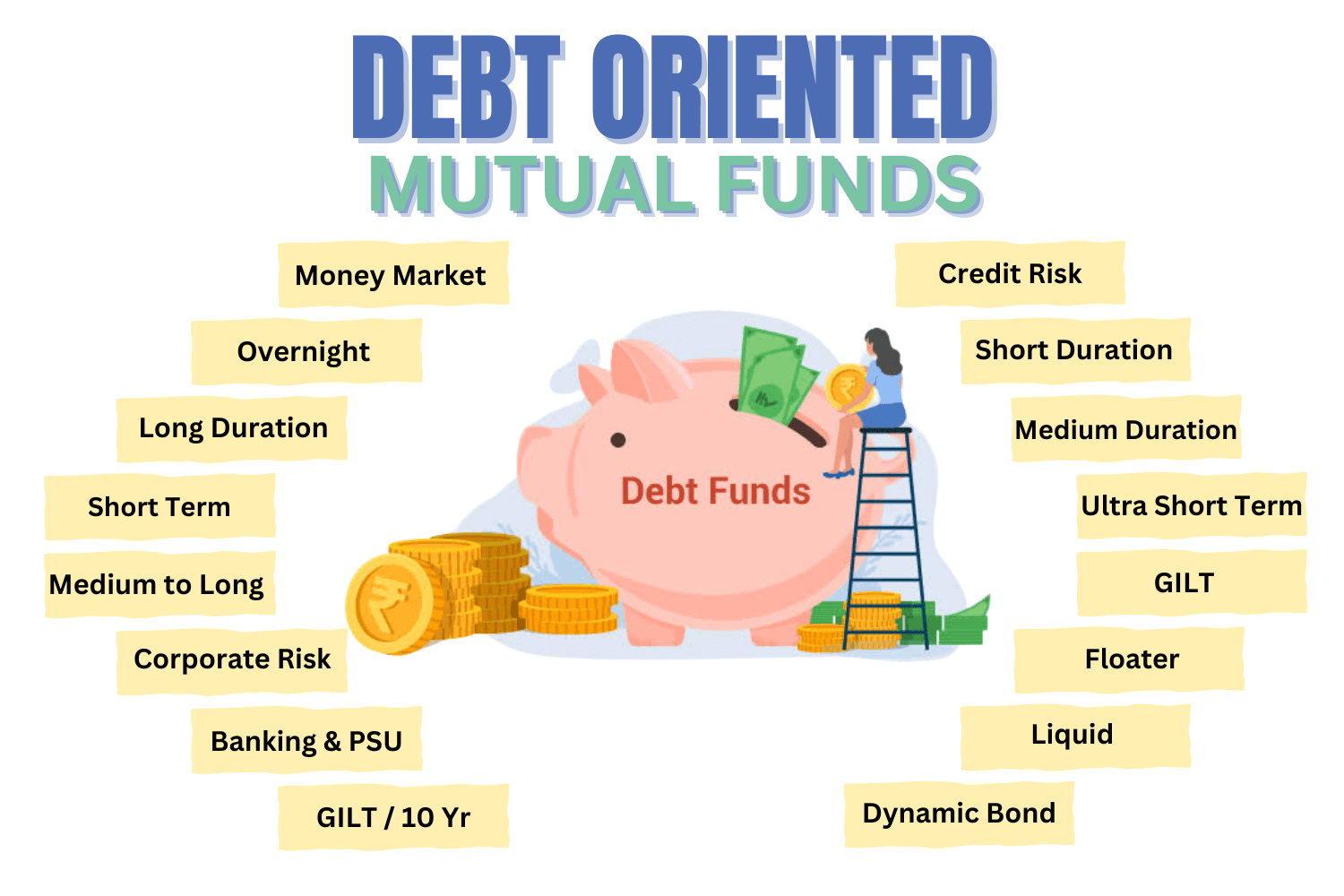

- Use mutual funds in India – Since we can’t buy retail CDs directly, I use ultra short-term funds that invest in high-yield CDs issued by PSBs. They’re regulated and offer easy exit options.

While CDs grow your idle money, the right credit card can save you money on everyday spending. Not sure which one suits you best?

Check out my blog on How to Select the Right Credit Card — simple tips to pick the perfect card for your lifestyle.

Final Thoughts: Should You Go for It?

If you ask me today, “Should I invest in a Certificate of Deposit?” — my answer is:

“Absolutely — if you have idle money, a clear time horizon, and want fixed returns without market risk. CDs are no-fuss, no-risk, and no-drama. Just make sure your timing is right.”

In a time when savings rates are still low and market volatility is high, CDs bring peace of mind and predictable growth. And trust me, once you start comparing numbers, you’ll wonder why you hadn’t done it earlier.

Have you ever invested in a CD, or maybe a short-term fund that backs CDs? What was your experience like? Share your thoughts in the comments section.

And if you found this blog helpful, pass it on — remember, 40% of people still make money decisions based on personal advice