Guard Your Finances—Protect What You’ve Worked Hard For. Avoid cybercrime with these small steps.

Introduction

Do you know? global losses due to cybercrime crossed a jaw-dropping $8 trillion, according to a report by Cybersecurity Ventures. That’s more than the GDP of most countries.

Closer to home, India saw over 2.5 lakh cases of cyber fraud reported in 2023, with financial scams topping the list (source: NCRB). Shockingly, experts estimate that for every reported case, multiple go unnoticed, as victims often feel embarrassed or unsure of how to report. In the first four months of 2024, over 740,000 cybercrime cases were reported to the Indian Cyber Crime Coordination Centre (I4C). Notably, approximately 85% of these reports pertained to online financial fraud

One study revealed that 70% of individuals reuse passwords across multiple accounts, making them easy targets for cybercriminals. Moreover, phishing emails—the most common form of attack—trick over 22% of recipients into clicking harmful links, often leading to financial theft.

The risks are growing as we adopt more digital payment methods. In fact, 75% of online consumers worry about the safety of their financial data but don’t take proactive steps to secure it.

Cybercrime isn’t just about big corporations; individuals like you and me are the primary targets. If you’ve ever logged into public Wi-Fi, ignored a software update, or clicked on an unknown link, you might have unknowingly opened the door to a cyber threat.

Below are 8 common ways cybercriminals can target you and how you can protect yourself from falling into their traps.

1. Real-Life Scam: Double-Check Your Online Deliveries.

A friend recently ordered home decor from FlipKart, via Instagram. Two days later, a delivery boy arrived with what seemed to be the product. The item was delivered without an OTP or prior notification, and it had been manipulated to resemble the original one. when he opened the box, he found an old, broken decor item. The next day, the actual delivery arrived. By then, the money was gone, and the fake delivery was long out of reach. He didn’t even check the price of the original item. The fake delivery guy quoted three times the cost of the original delivery item.

Cybercriminals are finding creative ways to exploit online shopping habits, and fake deliveries are one of their latest tricks.

How to Protect Yourself

- Always verify delivery details (tracking ID, OTP, or notifications) before accepting a package.

- Open the package in front of the delivery person if possible.

- Avoid paying in cash; digital payments through verified platforms leave a better trail for dispute resolution.

2. Stay Alert for Fake Job Offers and Easy-Money Schemes

Online scams often target people looking for jobs or side hustles. Have you ever seen those “Earn ₹5000/day from home” ads? They lure you in, ask for “registration fees” or “training charges,” and then disappear, leaving you high and dry.

How to Spot Scams:

- Legitimate employers will never ask you to pay upfront fees.

- Research the company online before committing. Look for reviews and complaints.

- If the job description feels vague or promises sky-high earnings for little effort, it’s likely a scam.

3. Think Before Clicking on Emails or Messages

Picture this: You receive an email that seems to be from your bank, warning that your account will be frozen unless you ‘verify your details’ right away.” “The email contains a link to what seems like a real login page, but it’s actually a trick.” Phishing scams like these steal your login credentials and drain your accounts.

How to Protect Yourself:

- Never click on links in emails or messages asking for sensitive information.

- Type the official website URL directly into your browser each time.

- When in doubt, contact your bank’s official customer service line to confirm.

4. Don’t Trust Every QR Code

QR codes are everywhere now, from payments to restaurant menus. But did you know scammers can send fake QR codes that steal your money instead of transferring it? Imagine you’re selling a product online, and the buyer asks you to scan a QR code to “receive” payment. The next thing you know, your account is debited instead.

How to Stay Safe:

- Only scan QR codes for payments you initiate, not ones sent to you.

- Double-check transaction details before confirming any payment.

- Set transaction limits on your UPI or wallet apps for added protection.

5. Think Twice Before Using Public Wi-Fi

Free Wi-Fi at cafes or airports seems convenient, but it’s often a goldmine for hackers. They can intercept your data while you’re browsing and steal sensitive information like passwords or banking details.

How to Protect Yourself:

- Avoid accessing sensitive accounts over public Wi-Fi.

- If you must use it, connect through a Virtual Private Network (VPN) for secure browsing.

- Switch to your mobile data for quick financial transactions instead.

6. Keep Your Devices and Apps Updated

Neglecting updates on your devices can leave them vulnerable to malware or hacking attempts. Many people don’t realize that those “Update Now” notifications often fix critical security issues.

What You Should Do:

- Turn on automatic updates for your operating system and apps.

- Use trusted antivirus software to detect and block malware.

- Avoid downloading apps from unknown sources or unofficial websites.

7. Investment Scam – Real Life Example of Cybercrime

“My own family member invested ₹50,000 in a random investment app.

“The app claimed that we could buy products that wouldn’t be delivered but would credit 5% of our investment back daily i.e. ₹2,500/- per day. They said we’d recover our investment in 20 days, and any amount credited after that would be profit” That’s what she told me.

She trusted this scheme because she saw evidence of another family member’s profits. She even tried to recommend it to others to earn bonus rewards.

Fortunately, she recovered her investment before the app was exposed as a scam and shut down. However, others who invested more recently likely lost significant money.”

Everyone wants to grow their savings, but some investments promise unrealistic returns and leave you with nothing. A common scam involves platforms that guarantee “30% monthly profits.” They might even pay out small amounts at first to gain your trust, but eventually, they vanish with your money.

Having a large amount of leverage is like driving a car with a dagger on the steering wheel pointed at your heart. If you do that, you will be better driver. There will be fewer accidents but when they happen, they will be fatal. – Warren Buffet

How to Avoid That:

- Be skeptical of any scheme promising guaranteed or high returns with little risk.

- Verify the credentials of the investment platform or advisor.

- Consult a certified financial advisor before committing to any large investment.

8. Be a Cyber Safety Ambassador

Cyber scams often succeed because of a lack of awareness. By sharing your knowledge, you can help protect your community from financial fraud. This is especially important for vulnerable groups like seniors who might be less familiar with digital threats.

How to Make a Difference:

- Share cybersecurity tips with family members, especially those who are less tech-savvy

- Help children understand the importance of online safety and password protection

- Keep yourself informed about emerging scams and share warnings with your network

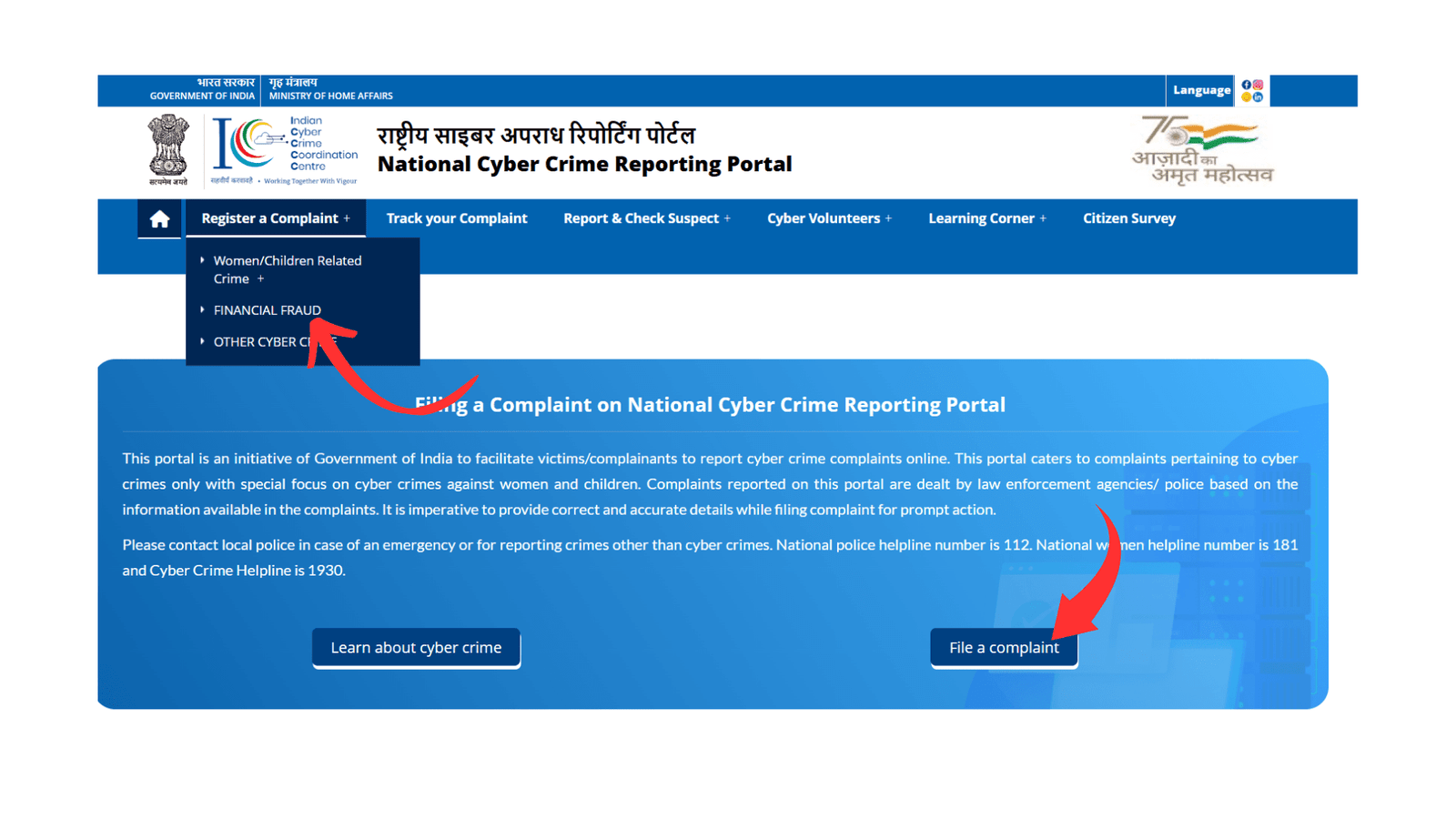

Where & how can I report cybercrime? Report cybercrime through these official websites:

If you have already lost money due to any cybercrime you can register the complaint by vising the portals below:

For reporting cybercrimes in India you can register a complaint by clicking the above link corresponding to India. After you click the link you’ll be directed to Indian cybercrime portal, at the header panel you’ll find “Register a Complaint+” button as shown in the below image.

The portal will ask for a mandatory data before raising a complaint like shown in the below image as you go through the process and you can login if you have an account or you have to create a new account by clicking “Click here for new user” link as shown in the below image:

If you need further assistance in filing a complaint you can either state the issue in the comment section or contact us through this link, we will try our best to help you.

Quick Tips for Everyday Online Safety from cybercrime

- Use Strong Passwords: Combine uppercase letters, lowercase letters, numbers, and symbols. Use a password manager if needed.

- Enable Two-Factor Authentication: Add an extra layer of security to your accounts.

- Monitor Your Accounts: Check bank statements regularly for unauthorized transactions.

- Shop Smart: Only buy from trusted websites. Look for “https://” in the URL and a padlock symbol.

- Stay Skeptical: If something feels off, trust your gut. It’s better to verify than regret.

Conclusion

The digital world can be tricky, but staying one step ahead of cybercriminals isn’t impossible. With a little vigilance and the right habits, you can protect your finances and your peace of mind.

Have you encountered any scams or know someone who has? Share your experience in the comments—it might just help someone else stay safe. 😊