Let’s imagine this — you needed ₹2 lakhs for your sister’s wedding next year. So, you joined a local chit fund, hoping it would help when the time comes. I, on the other hand, quietly put the same amount into a fixed deposit. Now, fast forward — let’s see who made the smarter choice for better returns.

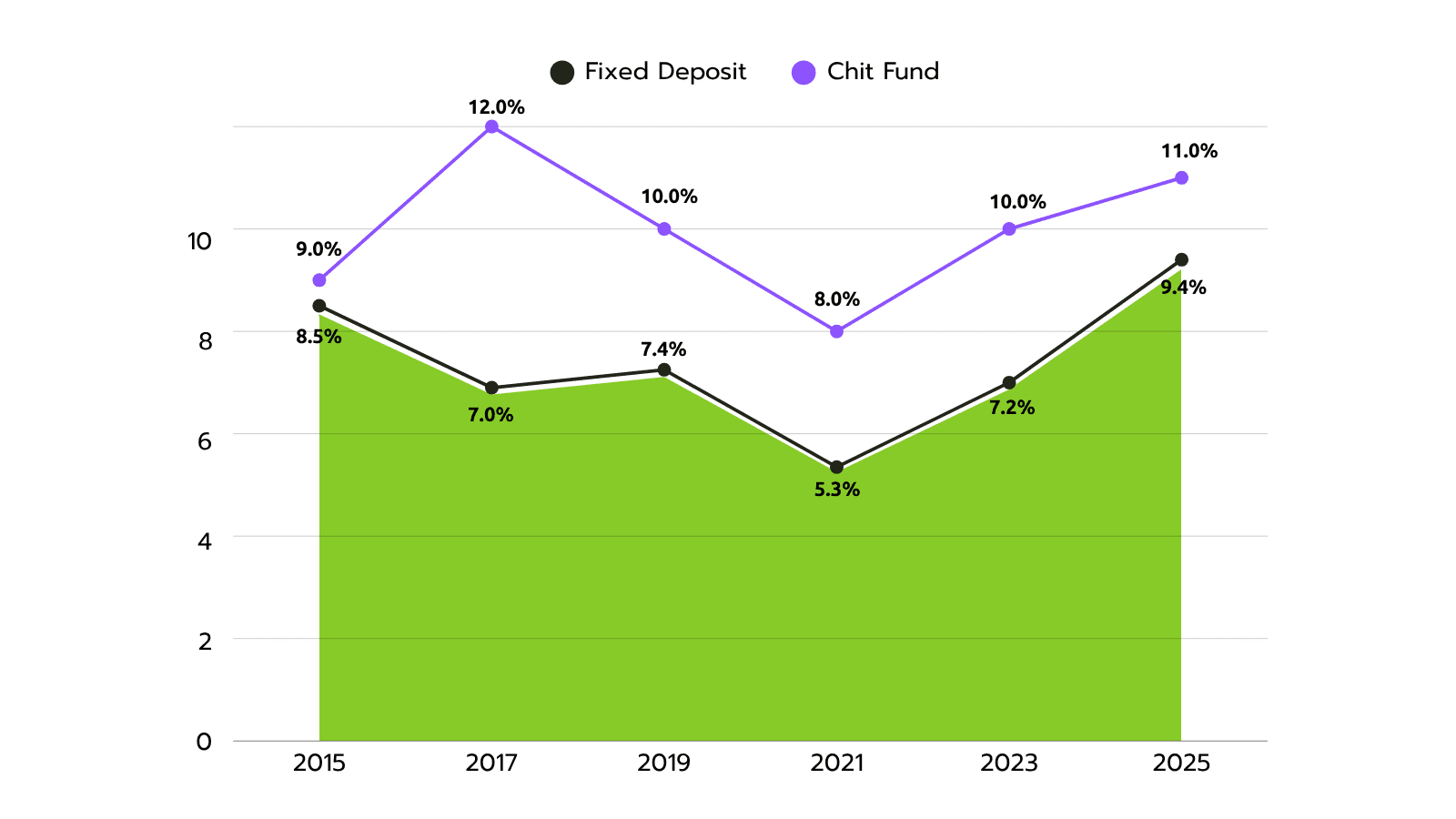

What chit funds give—and what FDs give

Chit funds:

- You pay monthly instalments, say ₹10,000.

- One lucky month, you win via auction or lottery and take out the pot minus a small discount.

- The “discount” becomes the earnings for the remaining members.

- Average annualised return? About 12–14%, sometimes up to 15%

Fixed Deposits:

- You deposit a lump sum—say ₹2 lakhs—for a fixed term at a fixed interest rate.

- Today’s FD rates are around 6–7%, with some banks and post offices offering rates as high as 8%.

- Returns are guaranteed and predictable.

Survey says: who trusts what?

A 2020 survey of 10,000 low-income Indian households found that 70 % prefer chit funds or informal methods over formal savings.

Reasons cited: social trust, accessibility, flexibility.

This shows why chit funds remain popular, especially for those who may not trust banks or lack easy access.

Risk vs. Reward — Real-life voices from Reddit

One Hyderabad investor shared:

“It’s a 20 month chit… at the end of the chit … I save a good 35–40k in this tenure. But again this is risky”. Reddit.

Another Mumbai investor said:

“Chits are handy for getting quick cash and saving up, but they’re not the best for long‑term wealth. Your returns depend on how the bidding goes, and inflation can really cut into profits.” Reddit.

- Contrast with FDs:

- Guaranteed, but lower returns; hardly beat inflation.

- No auction risk or defaults, like in unregistered chit funds.

Comparing returns, risks, and access

| Feature | Chit Fund | Fixed Deposit |

| Average return | ~12–14 % p.a. (sometimes 15 %) | ~6–9.5 % p.a. (wide range) |

| Risk | Moderate–High (default risk, fraud, unregulated) | Very Low (bank/post office insured) |

| Liquidity | Insured & regulated by the RBI/government | Locked-in; penalty if withdrawn early |

| Regulation | Moderate-High (default risk, fraud, unregulated) | Insured & regulated by the RBI/government |

| Use-case | Auction/lottery-based—can get a lump sum | Better for predictable, safe growth |

So, are chit funds better than FDs?

Pros of chit funds:

- Higher potential returns (12–15% vs 6–8%)

- Flexibility with lump‑sum access

- Community‑based discipline and trust

Pros of FDs:

- Predictable, steady returns

- Very low risk; often insured

- Good for long-term value preservation

Cons and risks of Chit Funds:

- Dependent on bidding outcomes, returns aren’t guaranteed

- Risk of fraud/unregistered schemes—need thorough vetting

- Inflation may eat into gains if returns are low/late

Cons of FDs:

- Returns may not beat inflation

- Early withdrawal penalties

- Less flexibility if short-term cash is needed

While comparing chit funds and fixed deposits might help you choose smarter, what’s equally important is avoiding rushed financial decisions—a mistake many make in their 20s. Investing in a chit fund just because it promises higher returns without understanding the risks, or locking all your savings in a fixed deposit just because it’s safe, can both be limiting. Your 20s are the best time to balance safety with smart risks, build an emergency fund, and diversify wisely, not just follow what friends or family suggest. Learning to research before investing is a financial habit that will reward you far more than chasing the “better returns.”

Wrap-up

“Chit funds can beat FDs in returns (12‑15% vs 6‑8%) and help you access cash fast—but they come with risk and require careful vetting. FDs offer safety and predictability for better returns. For your ₹2 lakh, the chit was great. But for long-term savings, I’d still park money in FDs—or diversify.”

Chit funds: high reward, moderate risk, great for short-term needs

FDs: low risk, moderate reward, ideal for predictable savings

- Action points – if you’re exploring chit funds:

- Verify registration under the Chit Funds Act

- Check the organiser’s reputation and track record

- Prefer longer tenures—they tend to give better returns

- Align the chit duration with your actual financial goal

Need quick cash for a lump sum goal in a year or two? Chit funds may be smarter—if you choose a reputable, registered one.

Looking for safe, hassle‑free growth? Go for FDs or, even better, blend with other instruments (like mutual funds).