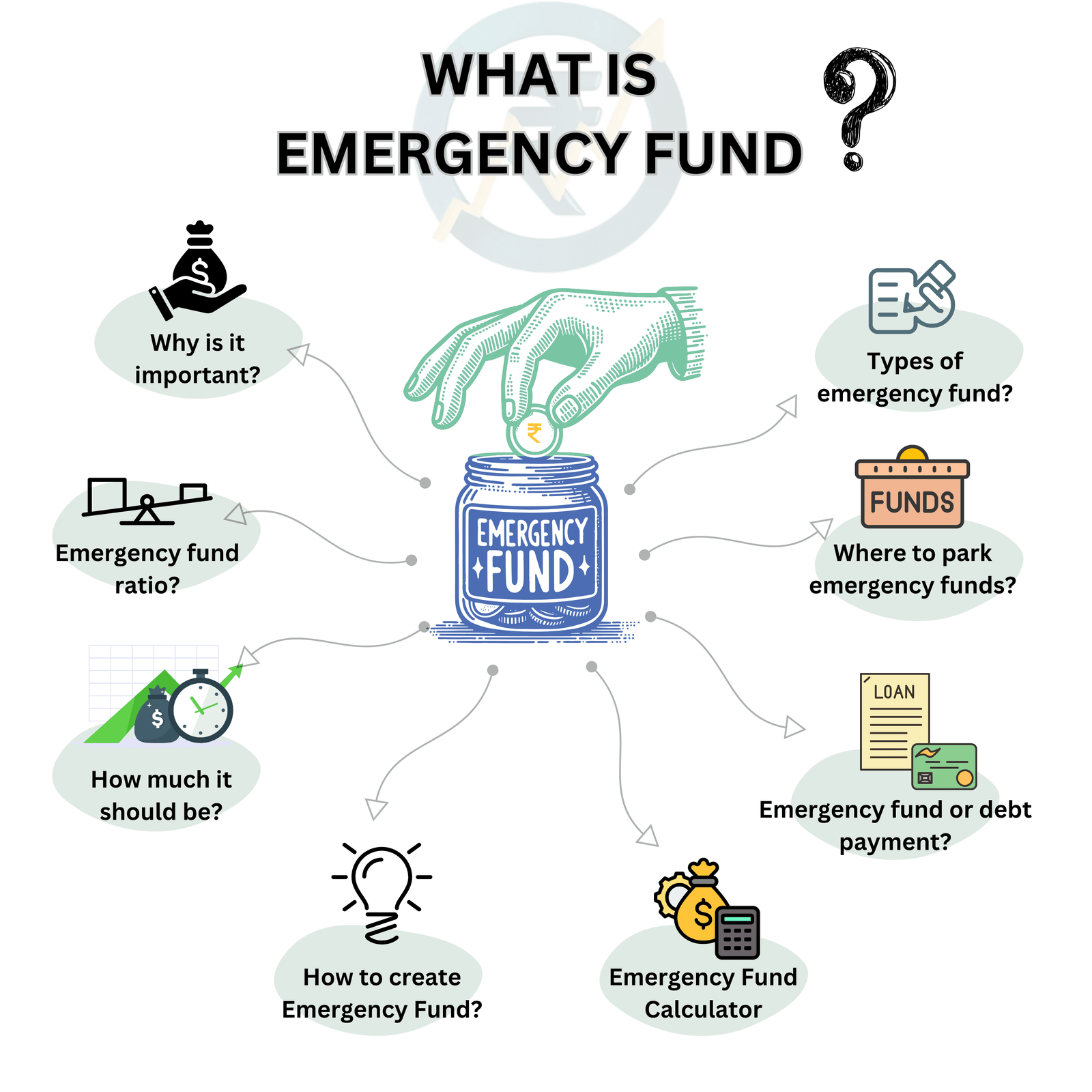

Even though most people know that having an emergency fund adds a great amount of relief in unanticipated life events, most of them won’t maintain it. Through this post, I have tried to write about all the relevant information about emergency funds. You can directly skip to the topic that you find relevant using the table of contents below.

Why do you need an emergency fund?

Tackle unexpected emergencies

Do you remember the year 2020, the COVID-19 year? How many months have you sat at home without any work? 3-5 months? Unless your family has any emergency fund kept aside it wouldn’t have been a piece of cake to maintain the same standard of life that you used to have before such covid-19 lockdown.

Not only that, how many times have you or your family suffered serious health issues till today? If any of you say not at once, would you guarantee that you and your family will not be affected by any serious health issues in the future? In such a case, if you don’t have an emergency fund, you have to go for an emergency debt by paying high interest rates, and most of you might not be left with many choices, right?

This is why having a properly planned emergency fund is more important for protecting your family than you might realize.

Ignore mental & financial stress.

If no emergency fund is kept to protect from unexpected expenses, you might end up taking money on debt or using credit cards at high interest rates. It might seem insignificant in an emergency, but without proper backup planning, paying debt with high interest rates would cause mental stress. You’ll lose your peace of mind and end up paying the majority of your income in debt interest.

Having an emergency fund is just a small decision that can make your life smoother than you think. This is one of the best financial plans.

What is an emergency fund?

An emergency fund is a pool of savings kept aside for unexpected outcomes or situations that require funds. The main aim of saving this money is not to earn interest on it but to meet a financial emergency.

Below are some of the major practical emergencies for which we need an emergency fund:

- Medical Emergencies that are not covered by insurance

- Job loss (not getting monthly salary paycheck)

- Unexpected travel due to family emergencies

- Unplanned child or educational needs

- Urgent home or car repairs

- Unexpected housing expenses

- Natural disasters like floods etc.

- Unplanned legal expenses

- Business related emergencies

- Unexpected tax penalties

- Economic or personal crises

How much should the emergency corpus be?

Your emergency fund size depends on your income, monthly commitments and your family’s insurance coverage. Generally,

- Three months’ expenses: If you are alone and have no one who can depend on you.

- Six months’ expenses: If you have a good dependent family. This should be essential to cover your family’s medical expenses, and reduction in your income or no income.

Where your brain can think of economic uncertainty or unstable job markets, some experts recommend saving up to 12 months’ worth of expenses.

Types of emergency funds

- Short-Term Emergency Fund:

- Purpose: Covers unexpected expenses like medical bills, car repairs, or urgent home repairs.

- Amount: Typically 3-6 months’ worth of living expenses.

- Duration: Short-term, usually used for immediate, one-time expenses.

- Long-Term Emergency Fund:

- Purpose: Provides a safety net for major life events such as job loss or income disruption.

- Amount: 6-12 months’ worth of living expenses, ensuring financial stability during periods of unemployment or unforeseen circumstances.

- Duration: Medium-term, covering extended income gaps.

- Specific Purpose Fund:

- Purpose: Set aside for a particular unexpected event, like medical emergencies, home damage, or funeral costs.

- Amount: Varies based on the estimated cost of the specific emergency.

- Duration: Short-term, used only for the specific emergency it is intended for.

- Health Emergency Fund:

- Purpose: Dedicated to health-related emergencies, such as surgeries, treatments, or urgent care.

- Amount: Depends on personal health risks and insurance coverage gaps.

- Duration: Short-term to mid-term, depending on the healthcare expenses.

- Natural Disaster Fund:

- Purpose: For emergencies arising from natural disasters like floods, earthquakes, or fires.

- Amount: Based on the location and potential risk of such disasters.

- Duration: Short-term, but it may also act as a cushion for recovery in the aftermath of a disaster.

- Travel Emergency Fund:

- Purpose: Covers unexpected costs while travelling, such as medical emergencies, trip cancellations, or lost luggage.

- Amount: Usually 10-20% of your travel budget.

- Duration: Short-term, typically used only during the trip.

Where to park emergency funds?

Many people will have a good idea about how much emergency funds they have to save, but they will make mistakes in parking their funds at the right place. Emergency funds should be kept at places where it is easy to access (liquid).

Choose one of the following to land your emergency corpus:

- Fixed Deposit with bank

- Any Liquid fund – These are mutual funds that invest in short-term debt instruments that are highly liquid, less volatile and have low risk. Liquid funds also include treasury bills, Certificates of Deposits (CDs) and Commercial Paper (CP)

- Short-Term Bond Fund – These offer similar characteristics to liquid funds but when it comes to liquidity not as good as liquid funds

- If you don’t feel confident about the above three, the last option is to open a separate savings bank account (easy to access) that offers a high interest rate

Don’t make these mistakes.

Do not save emergency money in your current savings account; maintain a separate one for better tracking. And do remember, even if you choose to park your emergency fund in any liquid fund, it will not be available to you immediately; you have to wait for 2 days (T+1) to get it into your hands. Choose this option only if you have an immediate source to get funds whenever you want.

For example: If you have a credit card, you can use your credit card in case of urgency as it will offer 1 month of free credit, and make payment when you receive an amount from this liquid fund.

If you don’t have credit cards or other immediate sources in case of urgency, I suggest you maintain a separate savings bank account.

Don’t make a blunder by investing these funds in stocks or mutual funds. These asset classes offer uncertainty and risk due to volatility.

How to build a sustainable emergency fund?

Step 1: Choose the type of emergency fund you need, and decide the amount of emergency corpus you want to build. Analyze your monthly income, necessary expenses, investments, and savings. If you are not able to figure out the approximate amount you want to park toward an emergency, decide whether you want to go for short-term or long-term and choose your emergency corpus accordingly (i.e., 6 months of expenses for short-term or 12 months of expenses for long-term).

Emergency Fund Calculator

Emergency Fund Calculator

Step 2: Choose where to park your emergency funds. Select one of the options that we have discussed earlier in this post. If you go with the savings account, do not mix it with your regular savings account; open a separate savings account.

Step 3: Split your income into necessary, comfort, and savings to see where you can reduce. Set a limit on those expenses that you feel are not necessary or important. Route those extra savings into an emergency. Continue the same process each month till you get your desired emergency corpus.

Step 4: Stay consistent in adding funds to your emergency corpus. Do not fill your corpus with borrowed funds; try reducing your monthly expenses wherever possible.

Step 5: Once your goal of corpus is reached, try redirecting any additional amount from next month into your long-term goals like retirement or investments. We aim to maintain an adequate emergency fund, but once we reach our goal, we want to ensure we don't miss out on the higher returns from long-term investments.

Step 6: In case of frequent financial emergencies, use money from your corpus but don’t give up on building it again till it reaches your goal. If you don’t feel confident about the goal amount of money that you planned to save previously, try reassessing it and plan your future additions to your fund accordingly.

Step 7: Review your fund annually. Try increasing it according to major life events and circumstances, such as marriage, moving to a new city, having children, an increased standard of living due to an increase in income, etc.

What is the Emergency Fund Ratio?

The ratio gives you an idea of how many months you can survive without having a single rupee of income from today.

Formulae:

Emergency fund Ratio = Emergency Corpus/Monthly living expenses

Example Calculation:

- Emergency Corpus: ₹2,40,000

- Monthly Living Expenses: ₹40,000

Emergency Fund Ratio=2,40,000/40,000=6

In this example, the emergency corpus ratio is 6, meaning the individual has enough savings to cover six months of expenses.

Emergency fund Vs Debt payment?

Of course, high-interest debt repayments should be your priority, but in my point of view, you should have an emergency corpus too. In the name of debt repayment, do not ignore saving money for emergencies; this will help you reduce the chances of increasing debt again in the future in case of an emergency.

What if you can handle only one? If you can bear only one of these two, try cutting your expenses that are not necessary. Follow these steps:

- Track your expenses

- Analyze your expenses to know where you can reduce

- Set a limit (budget)

- And keep the remaining amount that you have saved towards the emergency fund.

No matter how small, emergency safety is always better than having none at all.

Emergency fund Vs Investment?

The main intent of maintaining the emergency fund is

- Capital safety (no volatility).

- Immediate access to funds.

In the case of investments, there will be no capital guarantee, and we can’t access funds immediately.

As our first reason for earning money is to survive, any amount of money that can’t give us such freedom is always useless. So prioritize emergency corpus over investments.

Thank you for your time!

What do you think about this post? do share your thoughts in the comment section.