Last year, my cousin Sandhya wanted a safe, no-stress way to grow her ₹1 lakh. She didn’t trust stocks. Mutual funds felt risky. Fixed deposits? She had them already. That’s when I suggested the good old National Savings Certificate (NSC) — something our parents often swore by!

Let’s walk through what I told Sandhya — and what you should know too.

What is a National Savings Certificate?

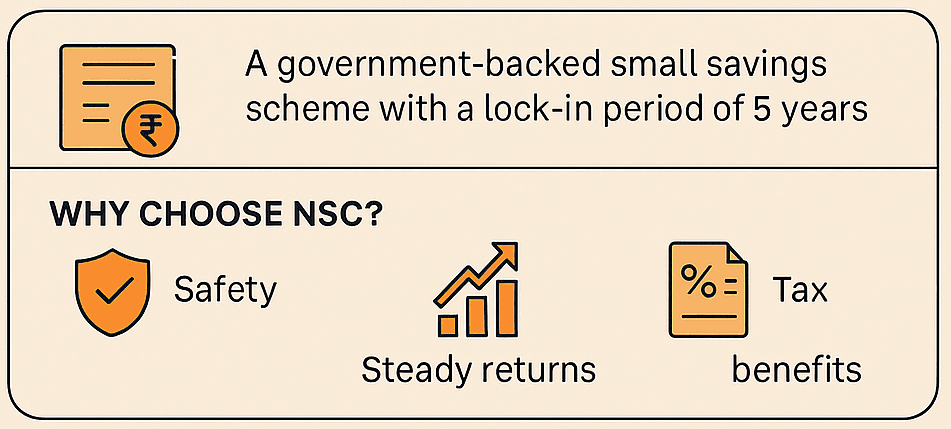

- A government-backed small savings scheme available at post offices across India.

- You invest a lump sum (minimum ₹1,000, no upper limit), and the amount grows at a fixed interest rate, compounded annually.

- The lock-in period is 5 years.

👉 Think of it as: You lend money to the government, and they return it with guaranteed interest.

Why Do People Choose National Savings Certificate?

- Safety — backed by the Government of India.

- Steady returns — no market risk, no surprises.

- Tax benefits — under Section 80C (up to ₹1.5 lakh per year).

Here is a detailed note by the Reserve Bank of India on National Savings Certificate.

NSC vs. Other Savings Options

| Feature | NSC | Bank FD | PPF |

| Tenure | 5 years | Flexible | 15 years |

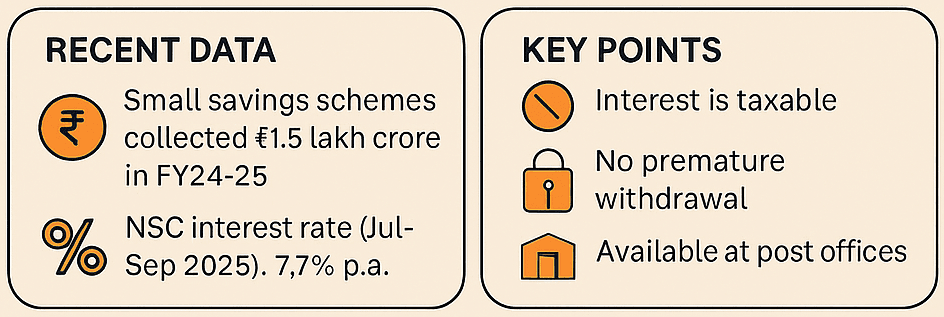

| Interest rate | 7.7% (July 2025) | ~6.5% (avg) | 7.1% (July 2025) |

| Tax benefit | Sec 80C up to ₹1.5L | Sec 80C (5-yr FD) | Sec 80C + tax-free |

| Risk | Govt. guaranteed | Bank risk | Govt. guaranteed |

👉 NSC gives better returns than many FDs, with government security, but is less flexible than a bank FD.

The Catch — What You Should Watch For

- NSC interest is taxable — unlike PPF, you pay tax on the interest when the certificate matures.

- Locked in for 5 years — no premature withdrawal (except on death or court order).

- Not available online (must visit the post office, though some banks assist in purchase).

NSC offers safety and fixed returns — ideal for building a secure financial foundation.

But what if you’re ready to explore higher returns?

If you’ve got your basics covered and want to diversify smartly, it’s time to look at Alternative Investment Funds (AIFs) — a world of private equity, venture capital, and more.

Who Should Consider NSC?

If you:

- Want a safe and guaranteed return

- Have Section 80C headroom and want tax savings

- Need a mid-term (5-year) plan without market volatility

- Are okay with paying tax on maturity interest

Final Thought — Why NSC Might Deserve a Spot in Your Plan

NSC is like that old, reliable scooter — not flashy, but steady and dependable.

If you want peace of mind, assured returns, and tax savings, it’s worth a look. However, balance it with investments that outperform inflation, because while the NSC protects your money, it doesn’t grow it aggressively.

Remember, when you can’t afford to lose, play safe. When you want to win big, mix it up.