Did you know that hybrid mutual funds have historically provided better risk-adjusted returns than pure equity funds during market downturns? and solution-oriented funds are specially designed to help you achieve life’s major financial milestones.

We’ve already explored equity and debt-oriented mutual fund schemes. But what if you need a mix of both? Or perhaps you require a fund that perfectly aligns with a long-term goal such as retirement? In this post, we dive into two crucial categories—solution-oriented and hybrid oriented funds—that offer a structured approach to wealth creation and financial security.

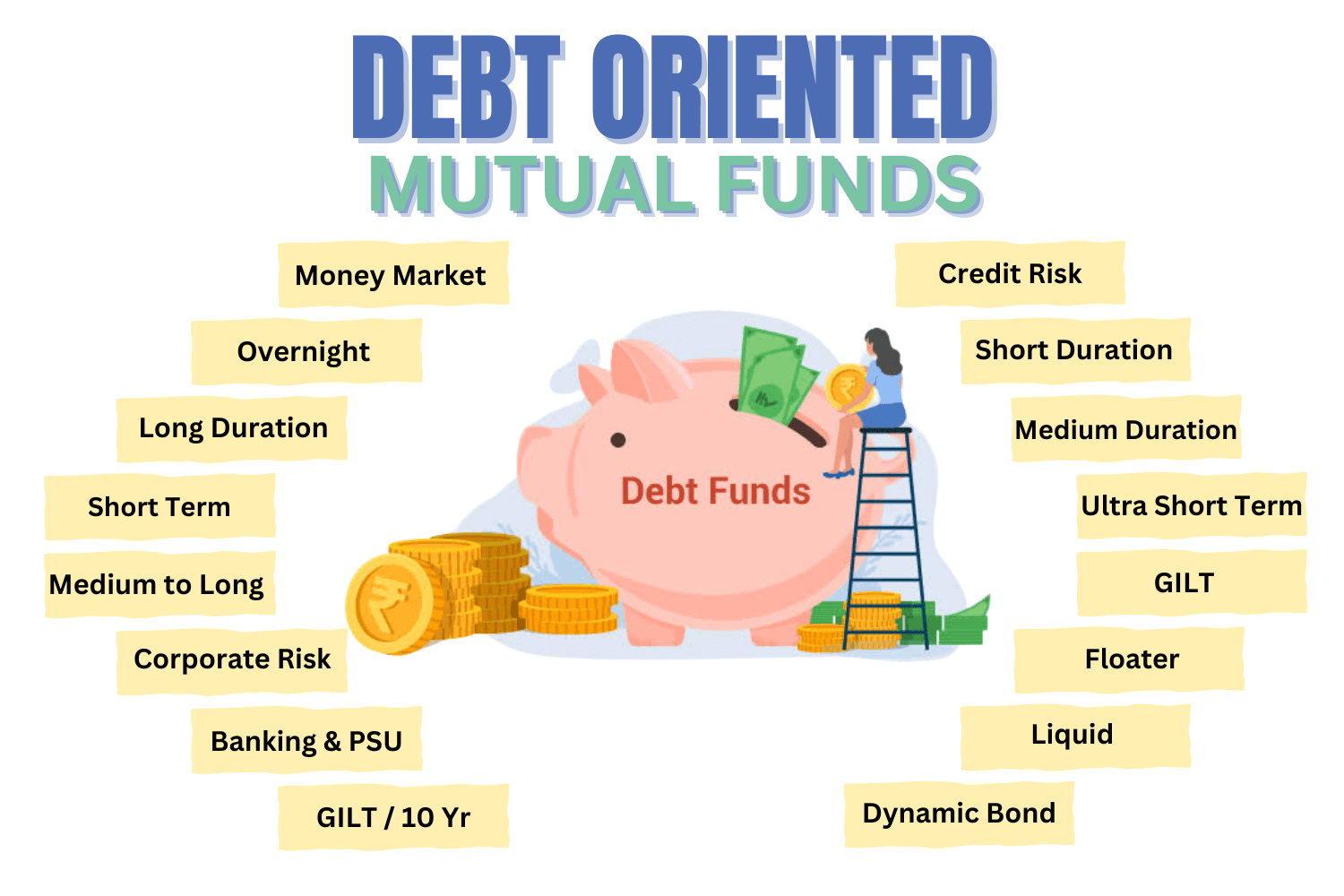

Here’s a quick link for types of Debt Oriented Mutual Funds and Equity Oriented Mutual Funds

A. HYBRID MUTUAL FUNDS

A type of mutual fund that invests in a mix of different asset classes, such as equities (stocks), debt (bonds, commercial papers, Treasury bills), and sometimes very small portion into securities like gold or real estate as a hedge against inflation and market volatility. The primary goal of hybrid funds is to provide a balanced and diversified investment option to help investors achieve moderate returns while managing risk.

Let’s dive into different types of Hybrid Oriented Mutual Funds.

1. Conservative Hybrid Mutual Funds

Conservative mutual funds are designed for investors who prioritise capital preservation and seek stable, steady returns while taking on lower levels of risk. These funds typically invest in safer, low-volatility assets, such as bonds, money market instruments and large-cap stocks, to provide moderate returns with less exposure to market fluctuations.

Features of Conservative Hybrid Mutual Funds

- Low to Moderate Risk: These funds invest in assets that tend to have lower volatility compared to equities, making them suitable for conservative investors.

- Capital Preservation: The main goal is to preserve the investor’s initial capital while generating modest returns.

- Steady Returns: Conservative funds may offer lower but more consistent returns over time, focusing on stability rather than growth.

- Income Generation: Many conservative funds provide regular income through interest from bonds and dividends from stocks.

- Diversification: Conservative funds are often diversified across different types of fixed-income instruments, such as government bonds, corporate bonds, and other safe securities.

2. Aggressive Hybrid Mutual Funds

Aggressive mutual funds primarily invest in equity markets with a focus on growth-oriented stocks, which carry higher potential returns but also come with increased risk. These funds may also have a smaller allocation to high-risk sectors or emerging markets that can generate higher returns over time but are more volatile.

Features of Aggressive Hybrid Mutual Funds

- High Equity Exposure: Aggressive funds are heavily weighted toward equities (stocks), often with more than 80% of their portfolio invested in stocks, including mid-cap and small-cap stocks, which have higher growth potential but also higher risk compared to large-cap stocks.

- Focus on Growth: The primary goal of aggressive funds is to achieve high capital appreciation. The fund managers choose stocks of companies that they believe will deliver high returns over time, often investing in sectors with significant growth potential, such as technology, healthcare, or consumer discretionary.

- Higher Risk, Higher Return Potential: Aggressive funds have the potential to generate higher returns, but this comes with the trade-off of higher volatility and risk. The value of the fund can fluctuate significantly based on market conditions, especially in bear markets or periods of economic instability.

- Investment in Small and Mid-Cap Stocks: Many aggressive mutual funds invest in small-cap and mid-cap stocks, which have the potential for higher growth compared to large-cap stocks. However, these stocks are also riskier because they are typically more volatile and less established.

- Long-Term Investment Horizon: Aggressive funds are designed for investors with a long-term investment horizon (typically 5 years or more). The idea is that, despite short-term market fluctuations, the fund will appreciate significantly over a longer period as high-growth stocks increase in value.

3. Balanced Hybrid Mutual Funds

Balanced mutual funds, also known as Hybrid Funds, are investment funds that allocate assets across different types of securities, primarily stocks (equities) and debt instruments (bonds, T-Bills etc). The goal is to provide capital appreciation, income generation, and risk diversification.

Features of Balanced Hybrid Mutual Funds

- Asset Allocation: Typically, these funds invest 40-60% in equities and the rest in bonds.

- Risk & Return Profile: Lower risk compared to pure equity funds but higher than debt funds.

- Regular Income (Growth Potential): Debt portion provides stable returns and income. Equity portion ensures the potential for long-term capital growth.

- Automatic Portfolio Rebalancing: Fund managers adjust the allocation based on market conditions. Helps maintain an optimal risk-return profile.

- Risk Mitigation: Diversification across stocks and bonds reduces market volatility.

- Regular Dividend Option: Some funds offer a dividend payout option, providing periodic income.

4. Multi Asset Hybrid Mutual Funds

Multi-asset mutual funds are diversified funds that invest in a variety of asset classes. They aim to capture returns from different segments of the market while managing risk by not relying solely on a single asset class (like equities or bonds). These funds are actively or passively managed, with the fund manager deciding the proportion of assets invested in each class based on market conditions and the fund’s investment strategy.

Features of Multi-Asset Hybrid Mutual Funds

- Diversification: The primary feature is the mix of various asset classes, which reduces the risk of the portfolio since different assets often behave differently in various market conditions.

- Risk Mitigation: Multi-asset funds can help smooth out volatility, as some asset classes may perform better when others are underperforming.

- Flexible Asset Allocation: Fund managers adjust the allocation between asset classes to take advantage of the most promising opportunities in the market.

- Goal-Oriented Investment: These funds can cater to various investment goals, such as capital appreciation, income generation, or capital preservation, depending on the allocation between equities, bonds, and other assets.

- Dynamic Strategy: Unlike funds that invest in a single asset class (such as an equity or debt fund), multi-asset funds are flexible and can adapt to changing market conditions by shifting allocations between asset classes.

5. Arbitrage Hybrid Mutual Funds

Arbitrage mutual funds are hybrid funds that take advantage of price differences between equity markets to generate returns. They buy stocks in the cash market (spot market) and sell the same stocks in the futures market (derivatives market) when there is a price difference. These funds aim to provide low-risk, tax-efficient returns by exploiting short-term inefficiencies in the stock market.

Features of Arbitrage Hybrid Mutual Funds

- Low-Risk Investment: Returns depend on price mismatches rather than market trends.

- Market-Neutral Strategy: Makes profits regardless of market direction (bull or bear market).

- Liquidity & Safety: Provides high liquidity as most holdings are in cash or arbitrage positions.

- Returns: Typically deliver higher returns than liquid or debt funds but lower than equity funds.

- Ideal for Short-Term Investors: A good alternative to liquid or short-term debt funds for low-risk investors.

6. Equity Savings Hybrid Mutual Funds

Equity Savings Mutual Funds usually invest in a mix of Equities (stocks) for capital appreciation, Debt Instruments for stability and fixed returns. This balanced approach provides lower risk than pure equity funds while offering higher returns than debt funds.

Features of Equity Savings Hybrid Mutual Funds

- Lower Risk than Pure Equity Funds: The debt portion provides stability. The arbitrage component further reduces volatility.

- Suitable for Moderate-Risk Investors: Ideal for investors who want higher returns than debt funds but lower risk than equity funds.

- Stable Returns with Downside Protection: The debt and arbitrage components help protect against market crashes. Equities provide growth potential in bullish markets.

- Regular Income Potential: Some funds offer a dividend payout option for investors seeking periodic income.

A little to know about Mutual funds from SEBI Circular on Mutual Funds

B. SOLUTION ORIENTED MUTUAL FUNDS

Solution-oriented mutual funds are designed to help investors achieve specific long-term financial goals, such as retirement planning or child education. These funds come with a mandatory lock-in period of 5 years or until the investor reaches a certain age, ensuring disciplined investing.

Key Features of Solution-Oriented

- Long-Term Investment Approach: Encourages disciplined savings with a minimum lock-in period of 5 years.

- Balanced Asset Allocation: Invests in a mix of equities and debt to balance growth and risk.

- Customizable Risk Profile: Some funds allow investors to choose between aggressive, moderate, and conservative plans. Risk levels vary based on the mix of equity and debt investments.

- Ideal for Goal-Based Planning: Helps investors stay committed to their financial goals without early withdrawals.

Let us know about different types of Solution-Oriented Mutual Funds.

1. Children’s Fund

Children’s mutual funds are a type of solution-oriented mutual fund designed to help parents save and invest for their child’s future needs, such as education, marriage, and other life goals. These funds typically have a lock-in period of 5 years or until the child reaches 18 years to ensure disciplined investing.

- Goal-Based Investing – Helps parents systematically save for a child’s future expenses.

- Equity & Debt Options – Available in equity, debt, or hybrid categories to suit different risk appetites.

- Lock-In Period – Minimum 5 years or until the child turns 18 (whichever is earlier).

- Tax Benefits – No direct tax benefits, but long-term capital gains taxation applies.

- Disciplined Savings – Encourages long-term financial planning with a structured approach.

2. Retirement Fund

Retirement funds are designed to help individuals accumulate wealth for their post-retirement life. These funds invest in a mix of equities, debt, and other instruments to provide long-term growth, stability, and income security.

- Long-Term Investment & Lock-In Period: Encourages disciplined savings with a lock-in period of 5 years or until age 60.

- Diversified Asset Allocation: Invests in a mix of equities and debt to balance growth and risk.

- Steady Growth & Retirement Security: The debt component ensures stability, while the equity component helps beat inflation.

- Gradual Risk Reduction (Glide Path Investing): Many funds reduce equity exposure as retirement nears. Ensures capital protection while still generating returns.

Who should invest in Solution-Oriented Funds?

- Investors with Specific Long-Term Goals – Ideal for retirement or children’s education planning.

- Disciplined Investors – Those who want to avoid frequent withdrawals and stay invested.

- First-Time Long-Term Investors – Suitable for those new to mutual funds but looking for a structured plan.

- Risk-Averse Investors – Those who want a mix of growth and stability with a goal-based approach.

🚫 Not suitable for short-term investors looking for quick liquidity.

🚫 Not ideal for aggressive traders who frequently switch funds.

C. OTHER MUTUAL FUNDS

1. Exchange Traded Funds

An Exchange-Traded Fund (ETF) or Index Fund is a type of investment fund that holds a basket of stocks, bonds, commodities, or other assets and trades on a stock exchange like a regular stock. ETFs combine the features of both mutual funds (diversification) and stocks (real-time trading), making them a cost-effective and flexible investment option.

- Traded Like Stocks

- Diversification

- Lower Expense Ratio

- No Minimum Investment Requirement

- Liquidity & Transparency

2. Fund of Funds (FoF)

A Fund of Funds (FoF) is a type of mutual fund that invests in other mutual funds instead of directly investing in stocks or bonds. It allows investors to gain diversified exposure across multiple funds with a single investment.

- Multi-Fund Diversification

- Professional Fund Management

- Higher Expense Ratio

- No Direct Stock/Bond Investment

- Types of FOF’s

- Domestic FoFs

- International FoF’s

- Asset Allocation FoFs

- ETF-Based FoF’s

Conclusion

Hybrid and solution-oriented mutual funds offer diversified investment options tailored to different financial needs. Hybrid funds balance risk and return by combining equity and debt, catering to various risk appetites. Solution-oriented funds focus on long-term goals like retirement and child education, ensuring disciplined wealth creation. Choosing the right fund depends on your financial goals, risk tolerance, and investment horizon.

Hybrid and solution-oriented mutual funds seem like excellent options for balanced investment strategies. It’s impressive how these funds cater to both risk management and long-term financial goals. Choosing between them requires careful consideration of individual financial situations. I particularly liked how the article explained ETFs and their flexibility.