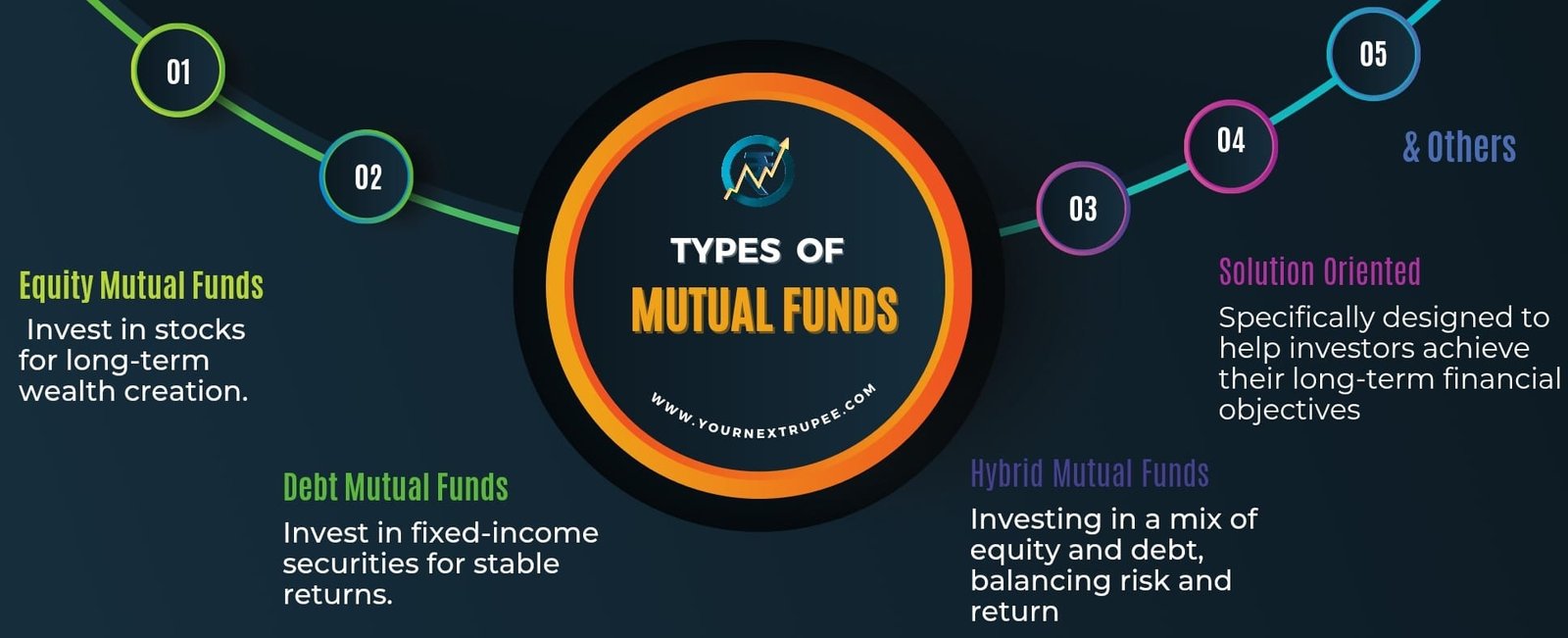

Understanding types of mutual funds and their characteristics gives you an edge in choosing the best mutual funds that align with your financial goal.

What are Mutual Funds?

Mutual funds are investment schemes operated by Asset Management Companies (AMCs). These companies employ a fund manager who has good expertise in selecting stocks through fundamental analysis. These funds collect funds, pool money from investors like us, and invest in diversified equity (stocks) and debt instruments (bonds).

To help you understand the framework for mutual funds, we will discuss stakeholders who work together to ensure mutual funds work smoothly and efficiently.

It involves AMCs, fund managers, trustees, custodians, registrars and transfer agents, distributors, advisors, and regulators.

How Mutual Funds Work: Process

The process starts with distributors & advisors. These are bankers, brokers, or online platforms who guide us (investors) in selecting mutual funds as per our financial goals. Once we have invested, the asset management companies (AMCs), such as SBI Mutual Fund, Nippon India Mutual Fund, HDFC Mutual Fund, etc., pool and manage those funds. A fund manager within such an AMC will invest such pooled funds into assets like stocks, bonds, or other assets as per the fund’s objective. Now trustees oversee the AMCs to ensure that the funds are managed properly in the best interest of the investor.

For example, trustees ensure that the funds that are pooled for large-cap funds are not being invested in small or mid-caps or other solution-oriented schemes. The custodians safeguard the funds underlying securities (share certificates, bond certificates, etc.) and ensure accurate settlement of trades. At the same time, issuing account statements, processing units, and maintaining investor records are being handled by registrars and transfer agents. Lastly, regulators (SEBI) monitor the entire process to protect investors’ interests.

Before we get into types of mutual funds, it is essential to know what small-cap, mid-cap, and large-cap stocks are. As per the SEBI circular issued in 2017,

Large-cap stocks = Top 1 – 100 stocks listed in India by market capitalisation.

Mid-cap stocks = Top 100 – 250 stocks in India by market capitalisation.

Small-cap stocks = Listed stocks ranked above 250 by market capitalisation in India.

The market capitalization of stocks may increase or decrease, causing their category to change—for instance, mid-cap stocks may become large-cap stocks, and vice versa.

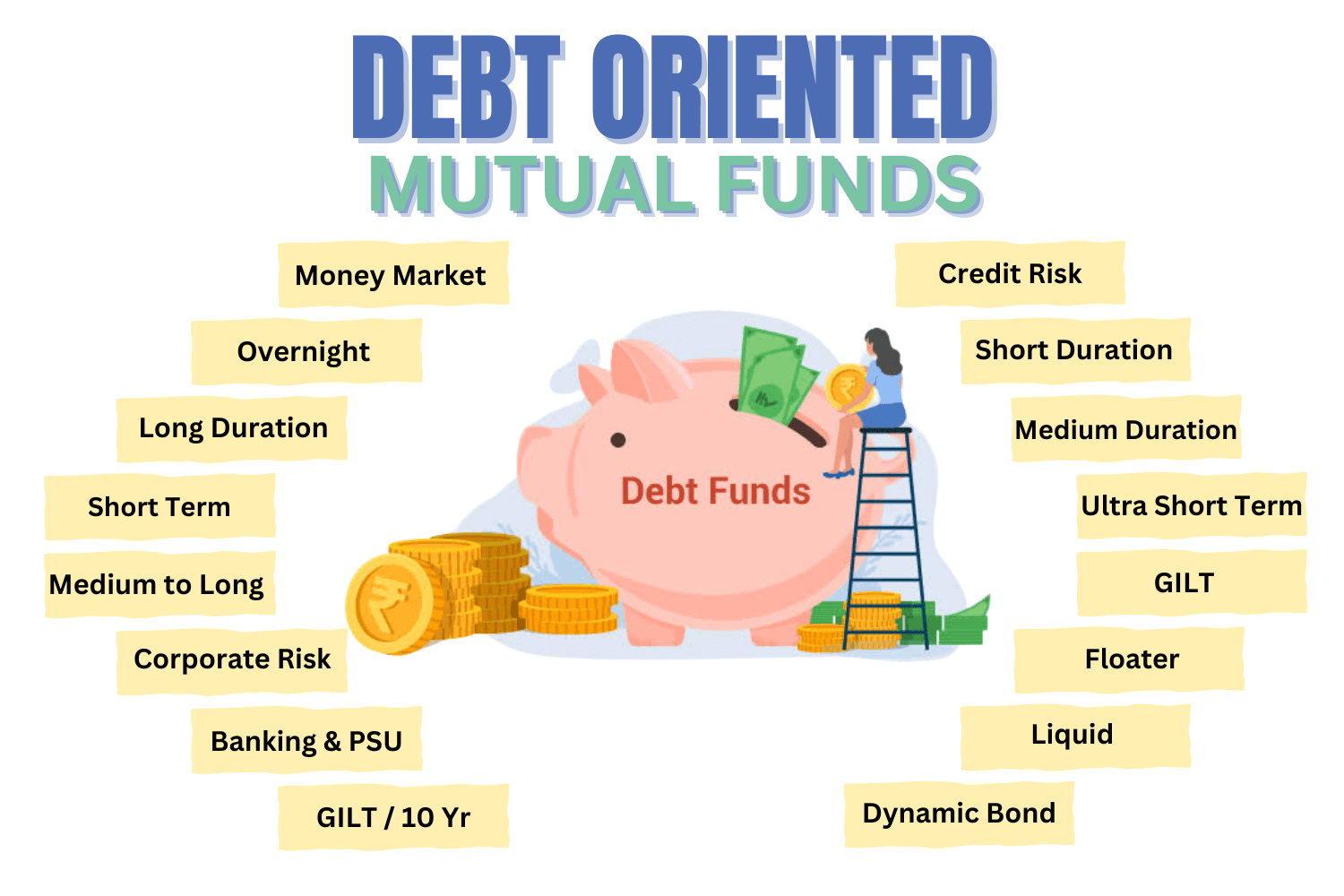

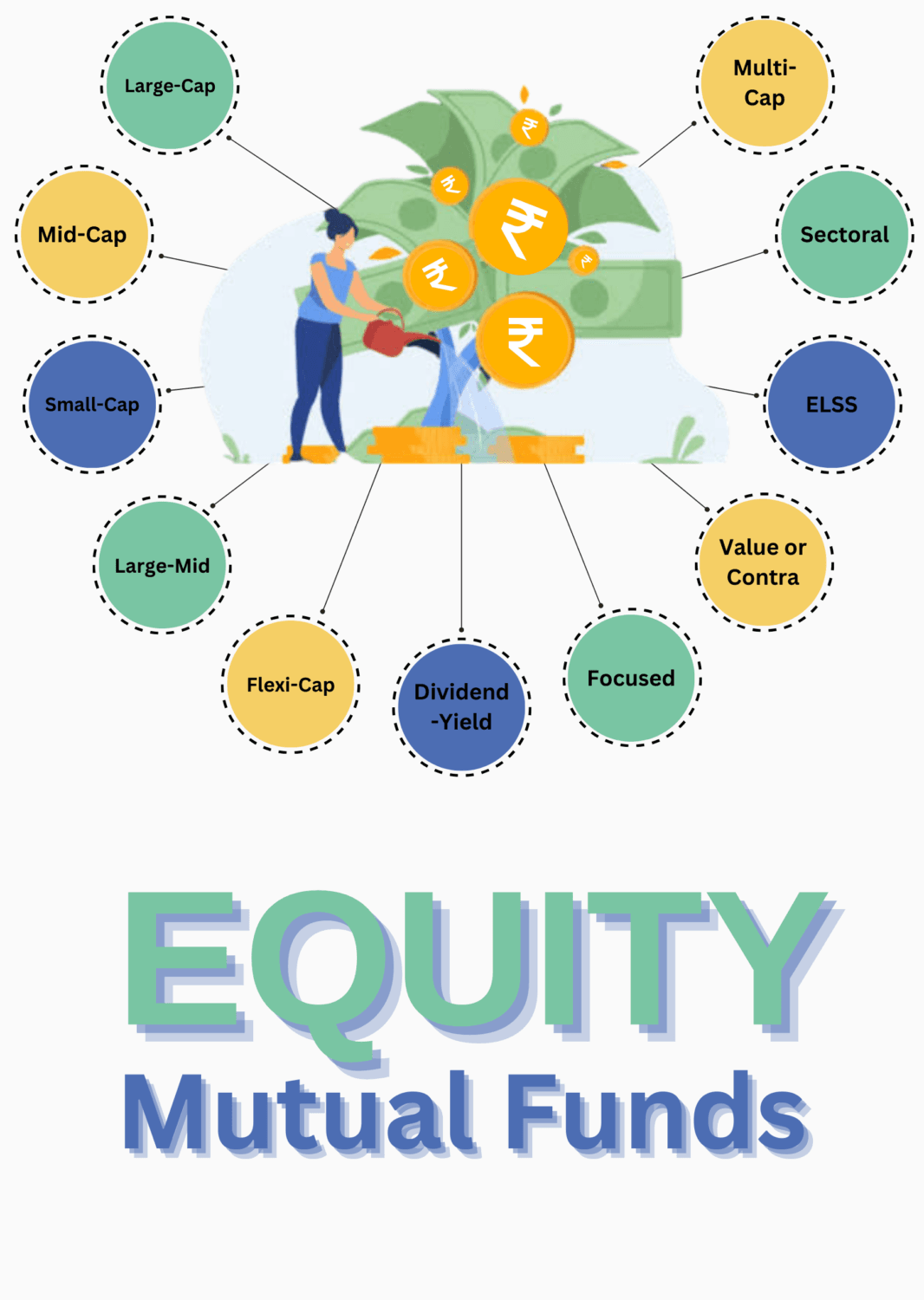

Types of Equity Mutual Funds:

These mutual funds invest the majority of their funds in equity instruments. Also known as equity-oriented mutual funds. The risks and characteristics depend on whether it is a large-cap, small-cap, or mid-cap. Stocks are highly volatile and therefore highly risky. There are 11 schemes under equity mutual funds. You can choose any one or more from those based on your financial goals. I’ve covered almost all the categories that are published in the SEBI circular. We will learn about all of them below.

1. Large-cap funds:

These funds invest at least 80% of their assets in the top 100 listed companies in India by market capitalization. Some might have thought they would only invest in large-cap stocks, but no, they have an option to invest in the small or mid-cap also up to 20% of their assets.

You can see the fund portfolio of stocks on the Coin app by Zerodha or in your Groww app. Just open any category of mutual fund and open holdings. You will see funds, all investments, and % of holding.

Less risky compared to small- & mid-cap funds as they invest in blue-chip companies. Purchases and sales of these stable companies happen regularly every day when the market is open, so these are highly liquid, meaning they are easy to transact.

Characteristics:

- Less risky compared to mid-cap & small-cap.

- Stable return over the long term.

- High Liquidity.

2. Mid-cap funds:

These funds invest at least 65% of their assets in mid-cap stocks. They can invest the remaining in other caps in any proportion. SEBI sets these limits to ensure clarity on the funds’ objectives.

Highly risky compared to large-cap; less risky than small-cap funds. Mid-cap companies have good growth potential compared to large caps, and they have medium- to long-term experience in running businesses. They are less liquid compared to large-cap stocks.

Characteristics:

- High risk compared to large cap funds.

- Good to great returns in the long term.

- Highly liquid compared to small-cap funds.

Small Cap Funds:

At least 65% of the total assets of these funds should go to small-cap stocks; as mentioned, these are stocks ranked above 250 by market capitalization. With this, you can say that these companies do not have much experience in doing business and huge growth opportunities if their resources are utilized effectively.

The data shows most of the investments into mutual funds are going into small funds compared to large & mid-cap as you can see below. Along with high returns, there will be high risk too; choose wisely.

Source: amfindia.com

Characteristics:

- Highly risky compared to Large & Mid-cap funds.

- Great returns in the long term if everything else works well.

- Less liquid compared to other funds.

Large & Mid Cap Funds:

As the name of the fund suggests, these funds should diversify their assets of at least 35% each into large and mid-cap stocks. This fund offers great support for those who want stability in their investments along with growth potential in the long term. Here, all the schemes except focused funds have no limit on the number of stocks or instruments the funds can invest in.

Main Motive: Offer the risk & return characteristics of large-cap and Mid-cap stocks.

Flexi-Cap Funds:

Here, the fund manager has the freedom to select any stock cap, i.e., small-cap, mid-cap, or large-cap, without any restriction. His fund portfolio includes even debt instruments. The only limit that this fund has to follow is that at least 65% of the total assets of funds should be equity-oriented. This does make sense as it is covered under equity mutual funds.

This fund can act as a good investment option, but choosing it or not still depends on many factors, such as fund manager, benchmark, total expense ratio, etc., which we are going to discuss again later.

Main Motive: To take advantage of all the stock caps.

Dividend Yield Funds:

As the name suggests, these funds invest in listed stocks that offer regular dividends to investors. These funds should have at least 65% of the total assets in dividend stocks, the same as the above funds. These stocks need not be large-cap; they can even be mid-cap stocks too.

Main Motive: To Continuously obtain returns in the form of dividends.

Focused Funds:

The main difference between all other funds and focused funds is the limit on the number of stocks the fund manager can invest in. The fund manager can select up to a maximum of 30 stocks only.

Here we can face a great risk if those stocks aren’t chosen right. Therefore, before selecting this fund to invest in, ensure the fund manager has great experience and expertise along with previous track records in selecting good stocks.

Main Motive: To select some specialized and focused stocks.

Value or Contra:

Value or contra funds are an option for high-risk-taking investors. This type of mutual fund is special because they invest majorly in undervalued stocks, which are fundamentally strong, expecting high future potential, and can include mostly mid-cap and small-cap stocks in their portfolio.

Equity Linked Savings Scheme (ELSS):

These funds are specially designed for saving tax on our total income. The Income Tax Act in India offers 80C deductions while computing your income taxes payable to the government; ELSS is one of the options. If you invest in an ELSS mutual fund, you will get an income reduction of up to Rs. 1,50,000/-.

They should invest a minimum of 80% in equity & equity-oriented instruments and have no restriction on the market cap of stocks.

For example, if you have a total income of 15,50,000, income is computed as per slab if you file income tax returns of your own. The total taxable income on which tax is calculated will be Rs. 14,00,000/- instead of 15,50,000/- if you invest in ELSS FUNDS. In short, you have saved Rs. 35,000/- [(50,000 × 30%) + (1,00,000 × 20%)] tax on such investment.

Other tax savings schemes include:

Life insurance, Public Provident Fund(PPF), Fixed Deposit >5 years, Sukanya Samriddhi Yojana, etc.

Main Motive: To save tax.

Sectoral/Thematic Funds:

Focused on a specific sector or industry. It is a tough decision to choose a specific sector in the current fluctuating economy. Highly risky if the sector does not perform well.

Recently, IT sector stocks have had huge volatile behaviour after Donald Trump’s inauguration on Jan 20, 2025. It’s difficult to predict how the daily sector-specific news can change the course of sector performance.

If you have confidence in some emerging sectors like green energy and electric vehicle (EV) sectors, you might choose to invest in them for long enough.

Main Motive: Focus on specific sector or industry.

Multi-Cap Funds:

Almost have the same concept of the flexi-cap fund but here the fund has given some limits or restrictions on each cap of stock that the fund can invest in.

As per SEBI, a multi-cap fund must allocate:

- At least 25% to large-cap stocks.

- At least 25% to mid-cap stocks.

- At least 25% to small-cap stocks.

- The remaining 25% can be allocated at the fund manager’s discretion.

A minimum of 65% of total assets must be invested in equities.

Main Motive: Offer balanced risk and returns.

Also read